Fair Lending Compliance & Audit Training

Our comprehensive Fair Lending School will give you the tools, knowledge, and resources you need to do your job with confidence. There is no other training like it!

WHY WE EXIST

Our goal is to eliminate discrimination in the lending industry.

What We Can Do For You

FAIR LENDING SCHOOL 2.0

Newly updated comprehensive training course aimed at compliance and audit professionals.

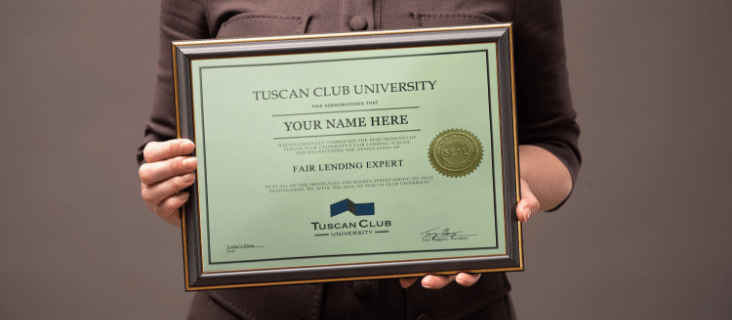

FLE™ (FAIR LENDING EXPERT) CERTIFICATION

Professional fair lending certification specifically designed for compliance and audit professionals.

FAIR LENDING EXPERT (FLEX) GROUP

Continue your fair lending education, get your questions answered, and network with other institutions in the industry.

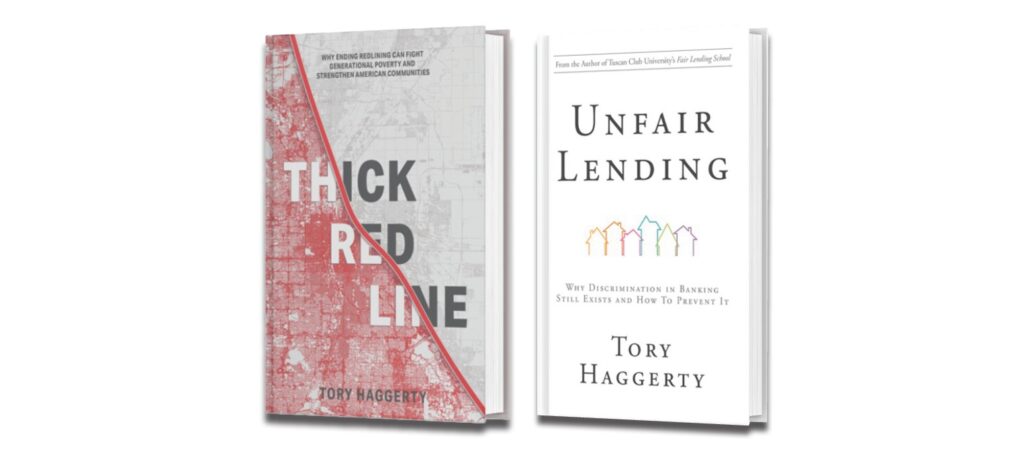

FAIR LENDING BOOKS

We have published two best-selling books on fair lending. Learn more below

FAIR LENDING AUDITS

We practice what we teach. If you are interested in us conducting a fair lending audit of your organization, reach out for a free consultation.

FAIR LENDING TRAINING

We have a one hour training that we can perform for your lending staff.

In his TEDx Talk, Fair Lending for a New Generation, Tory explores the history of lending discrimination and offers practical, actionable steps that anyone can take today to help combat illegal discrimination in lending.

We invite you to take just 10 minutes to learn more about this critical issue. Promoting fair and equal access to credit is essential, not only for individuals and families, but for the prosperity of entire communities.

Set Your Fair Lending Program up for Success

Fair lending can be complicated, and in many instances, you don’t get the training you need to set your fair lending program up for success. Our training teaches you everything you need to know to know about fair lending, including:

- Fair Lending Risks

- How To Minimize Those Risks Through Prevention

- How To Review And Audit Your Own Program

Lower Fair Lending Risk at Your Organization

Without the right fair lending program in place, your organization is at risk of violating fair lending laws and regulations.

This isn’t just stressful — it can also result in adverse exam ratings, enforcement actions, expensive litigation, financial penalties, and reputational damage. Our fair lending compliance training was created to help you avoid all of that and do your job with confidence.

Learn From Years of Compliance Expertise

At Tuscan Club University, we know you want to be confident in your role. In order to do that, you need the proper training. The problem is that fair lending seems hard, which makes you feel frustrated because you need training, and worried because you don’t know where or how to get it. It is not hard. Let us show you.

We believe that nobody should be put in a position of immense responsibility without the tools, knowledge, and resources to do their job. We understand that most training is surface-level, boring, and doesn’t teach you how to do your job any better than when you started. It’s the exact reason we’ve taken years of our compliance expertise and turned it into actionable training you can put to use.

Getting started is simple:

First, watch our free short intro video so you can see what the course will look like. Then, sign up for the course and learn everything you need to know to do your job with confidence.

Ready to begin? Sign up today!

And in the meantime, download “How to Build Prevention Into Your Fair Lending Program,” to find some practical tips to strengthen your fair lending program.

Ready to Get Started?

- Find out what is in Fair Lending School 2.0

The video to the left shows what our course looks like and the table of contents lays out everything that we cover.

- Sign up for the Training.

Complete the training and learn information you can put to use in your fair lending program.

- Stop Worrying About Your Fair Lending Program.

Have the tools, knowledge, and resources you need to do your job with confidence.

Check out our Fair Lending Books

Unfair Lending: We take a deep dive into the banking and lending industries and discuss how discrimination is often built within a lending program. Using the loan lifecycle of fair lending risks concepts, we walk you through getting a loan at a bank and the discrimination that can happen in the process. We also use real world examples of how banks have discriminated in the past and offer easy solutions on how to prevent discrimination in the future.

Thick Red Line: We take a deep dive into the history of redlining and racial housing segregation in the United States. We discuss what most redlining cases have in common and give financial institutions practical solutions on how to address this problem. We also look at several recent case studies, address appraisal bias, and so much more.

Money-Back Guarantee:

We believe in our training course, and we know this will be the best fair lending training you’ve ever experienced. We believe in it so much that if you don’t walk away with valuable content to improve your program, we’ll do whatever we can to make it right. If we can’t make it right, we’ll give you a full refund.

How To Build Prevention Into Your Fair Lending Program

We have created a list of 3 things you can do to prevent fair lending issues in each of the loan lifecycle risks. Simply enter your e-mail address to download.